The Trust Score is an intelligent rating system designed to establish a renter’s reliability and credibility when applying for places on the liv.rent platform. For renters, it’s an essential part of the Renter Resume to help rental applications stand out among other renters. For landlords, it is a crucial tool used to screen tenants efficiently. Using AI and a powerful algorithm that corroborates submitted tenant information, the Trust Score gives landlords a more secure and accurate measure of a prospective tenant’s suitability, allowing them to make better tenant screening decisions while ensuring they’re protecting their rental property investment.

As part of our continuous and concerted efforts to improve the liv.rent experience, we have recently enhanced this feature to work better for all our users – both landlords and renters.

Find the right renters faster with the Trust Score

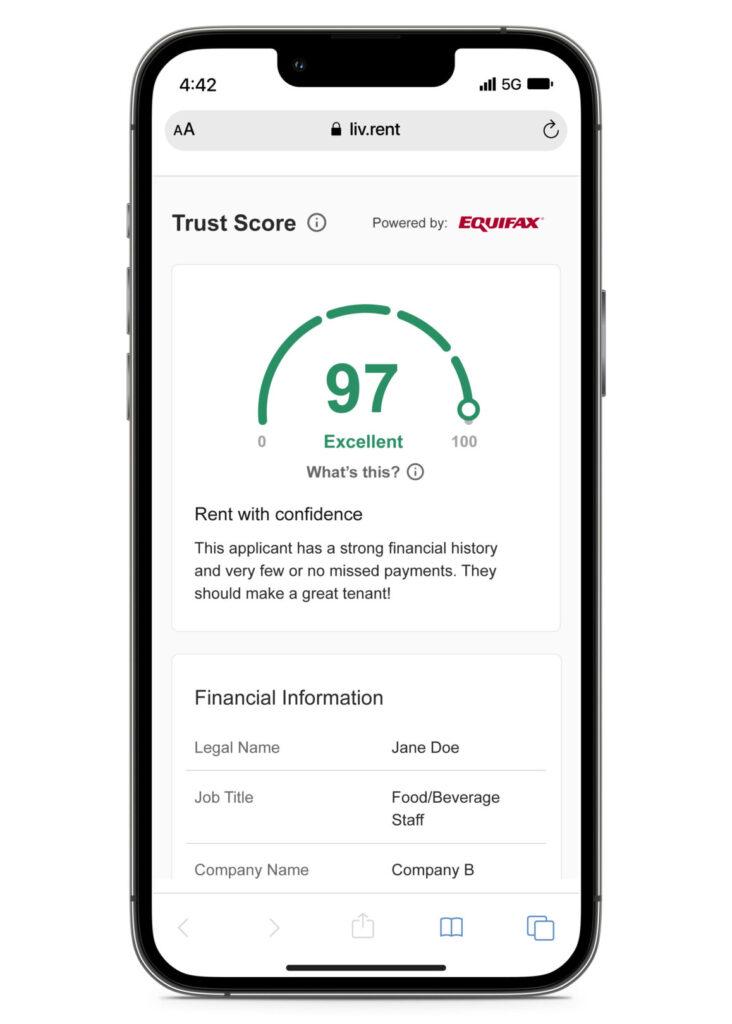

Unlock an easier, more effective way to screen renters. The Trust Score from liv.rent combines credit information from Equifax®️, income & employment verification, court records, and more into one easy-to-understand score. Click here to view an example of the Trust Score.

What is the Trust Score?

The Trust Score is an intelligent rating system designed to establish a renter’s reliability and credibility when applying for places on the liv.rent platform.

For renters, it’s an essential part of the Renter Resume to help rental applications stand out among other renters.

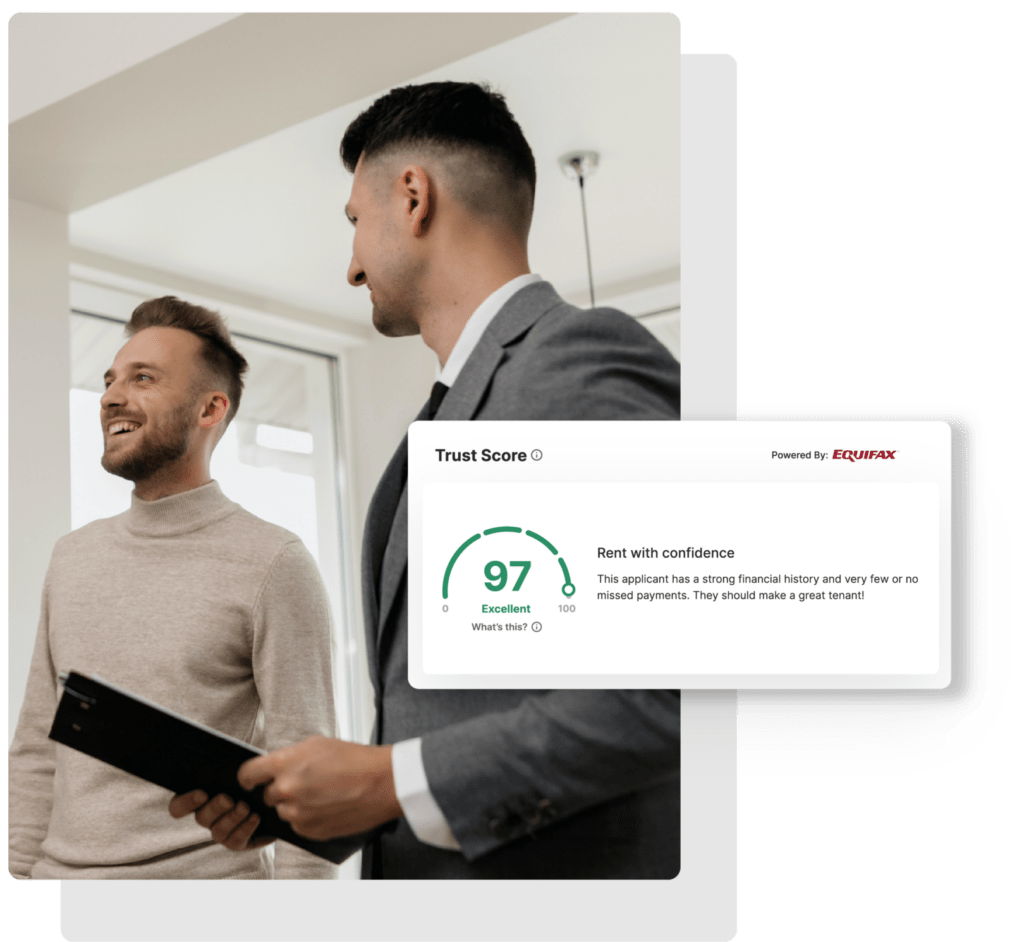

For landlords, it is a crucial tool used to screen tenants efficiently. Using Equifax® credit reports and a powerful AI algorithm that corroborates submitted tenant information, the Trust Score gives landlords a more secure and accurate measure of a prospective tenant’s suitability, thus simplifying their selection process. The Trust Score effectively goes beyond a normal credit score for landlords, giving an overall picture of the tenant’s rental history.

How does the Trust Score work?

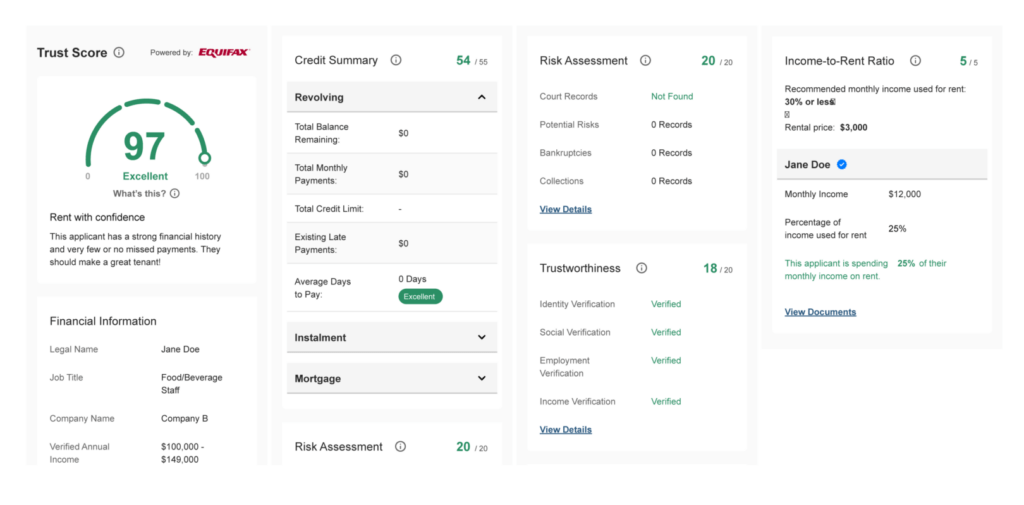

The Trust Score is broken down into four components meant to give landlords an impression of a renter’s financial history and reliability as they relate to renting. Functioning as a sort of tenant risk score, this information is presented on a scale of 100, with 55 points coming from an Equifax® Credit Summary, 20 points from a Risk Assessment, 20 points from our unique Trustworthiness rating system, and the remaining 5 from their Income-to-Rent Ratio.

Here’s a quick breakdown of how we calculate the Trust Score and where the information comes from:

- A credit check is conducted by Equifax® and provides a comprehensive picture of your financial credibility based on payment history, credit utilization, bankruptcy indicators, etc. This is largely the same information that would make up your credit score.

- The algorithm analyzes your profile, corroborating the details you provided with your public LinkedIn profile, photo ID, references etc. to determine your trustworthiness.

- liv.rent also automatically scans publicly available documents to gather any Court Records that may exist for a renter.

Does the Trust Score impact the tenant’s credit score?

The Trust Score gathers information from renters’ Equifax® credit reports and will appear as an inquiry on their credit file. This will impact their overall credit score, however the impact will not be significant since the Trust Score is not actually an application for credit.

A new credit inquiry is conducted whenever a landlord unlocks a renter’s Trust Score. Multiple inquiries within a short period generally count as one credit check, so when renters apply for numerous listings they are unlikely to see multiple inquiries on their credit history.

What does the Trust Score rating mean?

The Trust Score is presented to landlords on a scale of 100, with an intelligent Rating assigned for each range. Consult the table below for an overview of what each range means, and how it’s perceived by landlords.

| Trust Score | Rating | Renter |

| 90-100 | Excellent | This applicant has a strong financial history and very few or no missed payments. They should make a great tenant! |

| 75-89 | Very Good | You should have very little to worry about with this applicant when it comes to receiving rent payments on time. |

| 60-74 | Average | This applicant has a fair financial history, though they might have missed payments in the past. You may want to request additional documents that prove their financial suitability. |

| 0-59 | Poor | This applicant may have a history of not paying bills on time. We recommend that you request additional documents that prove their financial suitability. |

How can landlords use the Trust Score?

Landlords can use the Trust Score to gain a comprehensive picture of prospective tenants’ rental and financial history. For any renters that apply to their listings, landlords have the option to unlock their full Trust Score report.

Once landlords use a credit to view the renter’s report, a credit check is conducted and the following information becomes visible to the landlord:

- An Equifax® credit summary

- Court & Collections Records

- Potential Risks

- Bankruptcy records

- Income-to-Rent Ratio

- …and more

In addition, their Trustworthiness score will reveal:

- Which piece of ID they used for Identification Verification

- Income Verification and Employment Verification – separate verifications that can be attained by the following documents:

- T4

- Pay stub

- Employment letter

Tenant viability and reliability is further confirmed by:

- Income-to-rent ratio

- Court record verification (where applicable)

If a renter has entered their personal information incorrectly, credit information may not be available as their details must match Equifax® records. In this case, landlords will still be able to view applicants’ verification documents, income, and income-to-rent ratio.

Note: landlords are able to see all submitted tenant documents except for the picture ID, selfie, and full Equifax® credit report. However, as stated above, landlords will be able to see which documents were submitted for verification. Landlords will only be able to see this additional information when a renter applies to their listing.

How can renters use the Trust Score?

The Trust Score is an essential part of your rental resume, and helps you stand out when applying for rentals. The information you provide allows landlords to get a sense of your rental experience, financial history, and more at a glance, making it easier to build trust between parties.

Renters can choose from the following list of acceptable documents when verifying their income:

- Tax slips

- Bank statements

- Job offer letter

- Letter of employment

- Payslip

- Student loan financial statements

To verify their identity renters can upload any of the following:

- Drivers license

- Passport

- Canadian citizenship card

- Permanent resident card

- Selfie – this is to ensure that the submitted ID belongs to the person uploading the information

- Any other government-issued photo identification

Identification that is not accepted for ID Verification:

- Student ID

- Employee ID

- Library cards

What can renters do to improve their Trust Score?

There are a few steps a renter can take to boost their score, enhance their profile and improve their standing with landlords.

- Complete your profile. The more complete it is, the more likely a landlord is to prioritize an application. PRO TIP: According to liv.rent research, 88% of responded landlords say they prioritize completed applications.

- Connect your profile to your LinkedIn account

- Upload other financial documentation like pay stubs, letters of employment, etc.

- Upload a piece of government-issued photo ID.

- If you’re just starting out as a renter or are new to Canada, they should start building a good credit profile. A credit check for renting is an essential step for renters to prepare for.

- Get a mobile phone under their own name (not parents or spouse).

- Secure different types of credit. Credit bureaus love looking at different sources of credit when determining credit scores.

- To avoid missed payments set up automatic payments so it doesn’t happen again.

For more on how to improve your Trust Score, check out our complete post on the topic here.

Is your personal information secure?

Picture ID and Equifax reports are temporarily stored while the Trust Score is generated. Once verified, both are immediately and securely destroyed from our servers. Throughout the entire process, landlords will never receive or be able to view a tenant’s uploaded ID or Equifax report.

For more information, please refer to our Privacy Policy.

Ready to experience an easier way to rent? Take advantage of the Trust Score and other amazing features available on liv.rent and sign up here.

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

0 Comments